Pre-purchase and Pre-sale Valuations

To ensure you don’t list your property for less than what it’s worth, it’s important to get the property valued by an independent valuer. Unlike bank valuers who tend to be cautious when valuing properties or real estate agents who may overvalue a property to increase the commission they get when the property sells, an independent property valuer will independently value your property so that you find out the genuine value of the property. We carry out property valuations for pre-sale and pre purchase reasons.

Pre purchase valuations

Depending on the area of the market that you are considering purchasing a property in, buying a property can be an expensive decision. It could be a decision worth hundreds of thousands of dollars or millions if you’re planning to buy a property in the higher end of the market. Therefore, you want to ensure that you’re paying the right price. The right price means that you aren’t paying too much for the property and that you are paying what the property is worth. Therefore, it’s worth getting the property valued by an independent property valuer who has years of valuation experience and can correctly value your property.

All of Valuations TAS’s Valuers have formal qualifications and at least 15 years of local valuation experience so when they value your property, they are using prior knowledge combined with research to arrive at the final value that they give you. This can give you confidence that you have all the information you need to make an informed decision about the price you should offer to pay for the property.

Pre-sale valuations

When you’re selling a property it’s easy to get caught up in the emotion of the sale, especially when you’ve owned the property for a while and have an emotional attachment to it. That means you may list the property for more than what it’s worth. If you do that then there’s a chance that it will be on the market for longer than it should be. This is because even if someone loves the property they still couldn’t buy it because banks generally have strict lending criteria and they may not be able to get the finance required to complete the purchase.

A pre-sale property valuation is an independent assessment of what the property could reasonably be sold for on the open market.

Why choose us?

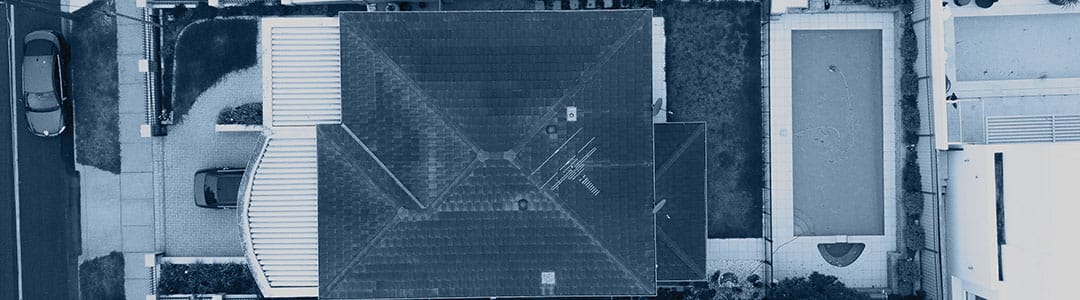

Valuations TAS is registered with the Australian Property Institute (API), and all of our property valuers bring a minimum of 20 years of local valuation experience. Our Certified Practising Valuers (CPVs)—many of whom also hold AVI and RICS qualifications—determine the true value of your property by researching comparable properties in the area and carefully considering various factors including:

- The location;

- The size of the home and its internal and external usable space;

- Condition and age of the property;

- Renovations and improvements;

- Supply and demand in the area;

- Planning and building regulations for example the zoning of the property, is it a residential or commercial area;

- Renovation potential;

- Interest rates;

- The economic conditions.

To get your property valued by an expert property valuer give our team a call on (03) 6169 2559.